SiteOne Landscaping (SITE): Enthusiasm Tempered By Imminent Slowdown

sturti/E+ via Getty Images

Overview

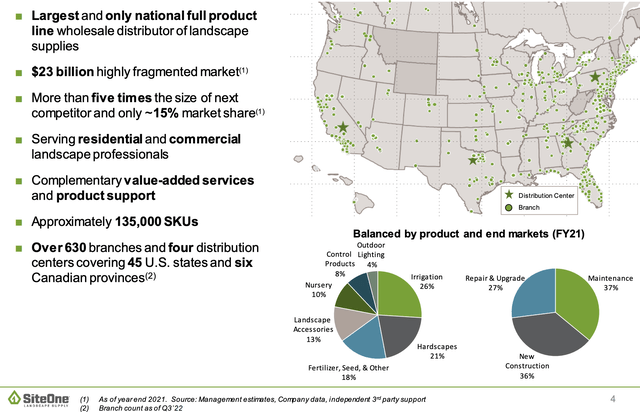

SiteOne (NYSE:SITE) is the largest national wholesale distributor of landscape supplies in the US & Canada, with ~15% share of the $23 billion industry. The company serves over 250,000 customers (residential & commercial landscapers) via 635 branches. At 5x the size of the second largest distributor, the company has significant competitive advantages versus peers including:

1/ Better buying power – it is able to procure product from vendors at lower prices than its much smaller competitors

2/ Ability to invest more in e-commerce and logistics initiatives to improve its customer service and on-time delivery capabilities

3/ Wider product (over 135,000 SKUs) & service offering than peers

Overview (Investor Presentation)

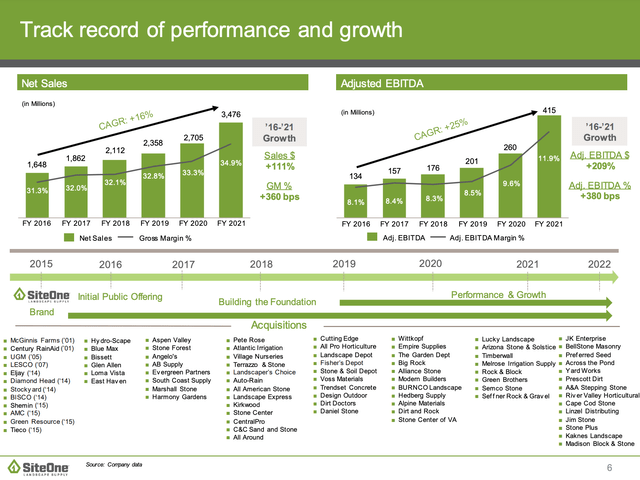

SITE is well positioned in the value chain as a ‘many-to-many’ (4,000+ suppliers and 250,000+ customers) distribution company whereby no supplier or customer has much negotiating leverage over the company (largest customer is less than 3% of sales ). As shown below, SITE has achieved tremendous growth in revenue and EBITDA over the past decade as:

- New construction markets (both residential & commercial) have been positive- this has been a powerful tailwind over the past few years though as I discuss below this is becoming a headwind

- Market share gains – organically the company believes it outgrows the industry by 3-5% given the competitive advantages cited above

- Acquisitions – the company has acquired over 75 companies in the past 12 years (discussed below)

Financial History (Investor Presentation)

A Successful Rollup

SITE has grown via an aggressive M&A strategy to roll-up leading local distributors and build out product capabilities. Since 2014, SITE has completed 78 acquisitions. With just 15% market share, there is ample room for continued organic and acquisitive growth.

SITE is able to achieve significant synergies in acquisitions including: better procurement terms, integrate its IT systems/e-commerce capabilities into the acquired business, and broadening the product offering of the acquired business as well as taking out duplicate back office costs (accounting, admin, etc).

Current Results are decent but likely to weaken in 2023

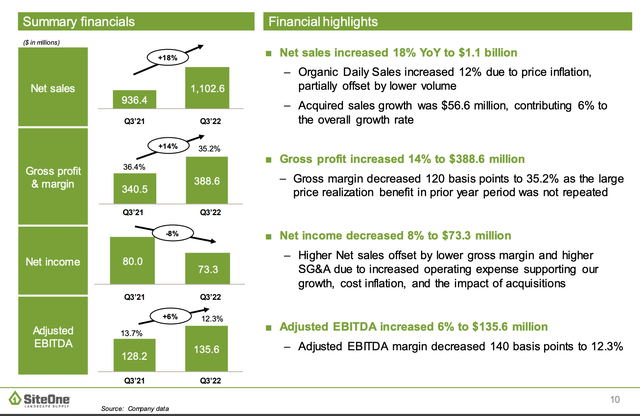

3Q22 results snapshot (Investor Presentation)

SITE recently reported a decent set of third quarter results with continued organic top-line growth, though this was completely driven by price as volumes declined in the third quarter. EBITDA margins contracted as inflation reduced gross margins and increase SG&A expenses.

While results have held up well thus far, going forward I expect we will see continued pressure on volumes – particularly as it relates to sales tied to new construction (36% of revenue). Landscaping is done at the end of a project – as such SiteOne will not feel the full impact of the downturn in construction until 2023 and into 2024 as the number of projects being completed declines significantly.

valuation

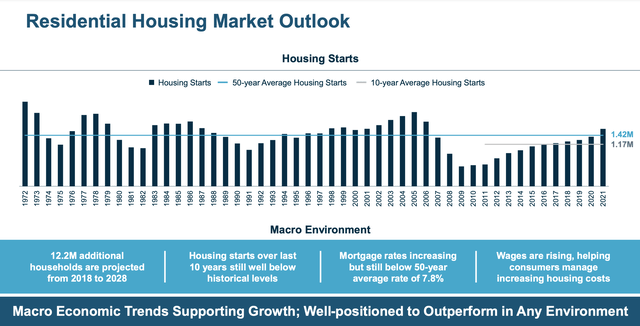

As mentioned above, I expect the portion of revenue coming from new construction (37% of total) to decline significantly over the next two years given the deterioration we’ve seen in the US homebuilding market (and pending decline in commercial new construction as rate hikes curtail new projects). Overall, I expect a 25-30% decline here as new home sales go from being above trend in 2021 to below trend in 2023-24:

US Housing Starts (Top Build Investor Presentation)

Further, I expect that we may see some deterioration in the portion related to ‘repair & upgrade’ (27%), particularly on the upgrade side as home price appreciation has become depreciation and consumers look to curb expenditures as the economy weakens. All-in, I’m looking for a 10-15% decline in revenue related to the housing/economic downturn.

While revenue declines, costs will remain sticky (and could continue higher given inflationary trends) which compression in EBITDA margins. All-in I’m basing my normalized earnings expectations on 9.5% EBITDA margins. While this reflects a 2.4% decline versus all-time high 2021 levels (when the housing market was on fire and gross margins were abnormally strong) 9.5% would represent the third highest margin levels in company history (on par with 2020 and behind only 2021 and 2022).

Applying the 9.5% EBITDA margin to reduced sales gets me to $340-345 million in estimated ‘normalized’ EBITDA which 25% below the midpoint of SITE’s 2022 guidance. Deducting interest, taxes, and capital expenditure this gets me to normalized free cash flow per share of $5 per share.

I think a 17-18x multiple is fair given the company’s leading market position with improving economics and ability to continue to create value for shareholders via acquisitions. This gets me to a fair value of $85-90/share.

Conclusion

SiteOne is a high quality business which is well positioned for the long term. Ultimately I’d love to own this business but my estimated fair value for the company is significantly below the current share price, I have no interest at the present time.

Comments are closed.